My Attempts at Motivational Methods of Money Management

During my path to Financial Independence, I’ve tried several different methods to make sure I’m staying cognizant of what I’m spending money on, and investing as much as possible… without taking away too much quality of life.

We still have probably close to a decade to go before we hit Financial Independence, so I am always thinking of and trying out new ideas to keep track of our numbers and stay motivated to continue to save and invest. The following are some methods I’ve tried so far.

Track Everything

I wasn’t very knowledgeable with spreadsheets prior to starting on my journey to Financial Independence, but when I started to realize the power and ease of plugging numbers in and graphs automatically updating, I decided to give it a go.

I could type in each transaction, which category(ies) it belonged in, and a chart would display how much money we spent in each category, broken down by month. A pie chart could show the total spent per category. That was pretty cool!

I didn’t have to subscribe to a website and input all my bank and credit card information, or rely on anybody else. It worked well and only required us to enter every transaction of money that changed hands.

However, after a number of months, we started to realize what a hassle it was for myself and my wife to record every time money changed hands. We continued trying it for a couple years, and then came to the realization that it was just annoying and wasn’t really changing our spending.

We had never recorded every transaction in previous years, we weren’t having any money issues, and we had a good idea of what we were spending money on. We decided that this type of budgeting wasn’t for us, and it wasn’t all that motivating either.

So, although we continued to keep track of recurring payments, health expenses, other big expenditures, and review every credit card statement, we stopped spending time recording every transaction.

Yes, there are several apps that will let you plug in your bank and credit card information and automatically keep track of your transactions. This is something we weren’t ready for at the time. It seemed a little invasive, and it didn’t get much consideration at the time.

Spend On What’s Important

One of the first things we realized when we tracked spending is that we didn’t want to stop spending money on – fun experiences. So we decided to start tracking what we were spending on trips and experiences.

We weren’t doing this to limit our spending, but rather to make sure we were spending money on fun things throughout the year. We want to give our kids memorable vacations, go to concerts, and think about other fun ways to spend our money.

Don’t get me wrong, not all fun activities require money. We enjoy and want to road trip, camp, and check out free and low-cost activities locally as well.

We also don’t want to try to force ourselves to save every dollar we make and just let life pass us by. It’s a balance.

Tracking Investments

My next thought to help motivate managing money and investments was to make another spreadsheet. This one would show how all of our investments were growing over time.

I logged in to each account once a month and put in the amount in each fund we were invested in. Over the course of the year we could see the growth… or lack there of.

This was fun to do and interesting to see, but it was too much. For one thing, my wife had no interest in seeing this data. I was hoping to come up with a way to motivate her, along with myself. For another, I tried this in 2018, and the stock market was pretty flat that year. So it wasn’t that fun to watch. When the stock market went down, I was reminded of how much money we lost that month, and I didn’t feel like being reminded of this throughout the year.

Much like keeping track of every transaction, looking up and recording every fund’s value every month took time and ended up not being as motivational as I expected.

We did continue to track all of our funds twice a year, and now we can look back and see how much our investments have grown over time.

Projecting Investments

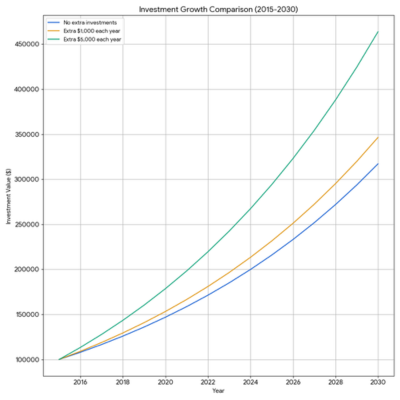

Tracking current numbers and comparing it to the past is great, but I finally started taking those numbers and projected them into the future. What if my wife and I continued to get small raises every year, we continued to increase investing, and our investments grew over time?

I set up scenarios showing how by investing just a little more would make a big difference in the long run. This projecting helped motivate me. I realized that I was worried too much about how the markets were doing, which I didn’t have much control over. If I wanted to think about the future, I should try to invest more and just let the markets do what they do.

Highlight Investing.

In recent years, In addition to projecting investments, I decided to track how much we are investing. Over the course of the year, I track all of the money that we put into our pre-tax and post-tax retirement accounts, the Health Savings Account, 529 accounts, and taxable brokerage accounts.

This has been another motivation for me. Being able to look at how much we’ve been able to invest each year shows some good habits that we will be able to look back on and realize why it is that we’ve been able to make good progress over the years.

Going Forward

Although we may be close to a decade away from having enough saved up to start withdrawing, I’m looking forward to more ideas and insight I hear from others regarding tracking, projecting, and preparing for Financial Independence.

I can see my wife and I trying out an app or two that tracks and projects our money better than my spreadsheets can, with a better user interface.

I can also see us potentially hiring an advisor who can look over our numbers and talk us through all the scenarios that we haven’t thought about yet.

We’ll see what kind of new money management techniques we try next.

Reader Questions

- How do you keep track of your current and projected financial numbers?

Leave your answers or comments below – or email us directly at info@epicfinancialjourney.com